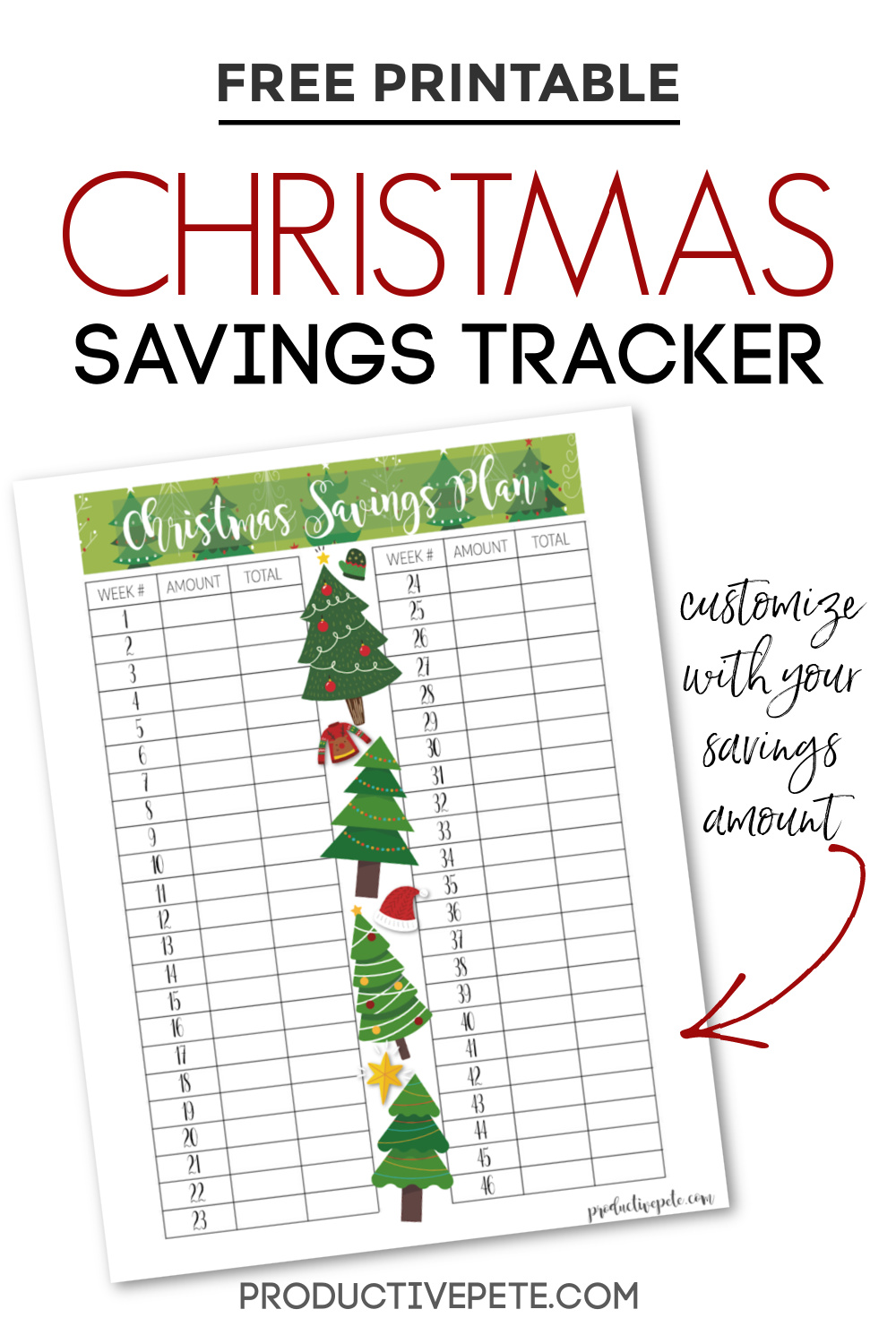

We decided that it would be really fun to stay in a downtown hotel and shop the expensive downtown mall and specialty shops for the Black Friday weekend.Īfter celebrating Thanksgiving with extended family, we hopped in a car and drove 3-hours south and stayed downtown for a couple of nights and shopped for two-days. In fact, I remember our second Christmas together very well. How we went deep in debt for Christmas early in our marriage Then we had cute little human beings, a time when many generally spoil and go “all-out.” Yes, we did it backwards. How ironic is that? When it was just the two of us, we went in debt for Christmas. Basically, ever since we have had children, our Christmases have been debt-free. We have spent the last 13 Christmases debt-free. But it is still sorta depressing to talk about, see it and have it floating around you in the middle of summer.īut the truth is…if we DON’T talk about it now, if we don’t think about it now and if we don’t plan for it now, it will be a killjoy during Christmas time. I was in Hobby Lobby the end of July, and they already had Christmas stuff up! It does make sense for a craft store, because being a hobbyist myself, you need a few months to make your projects so you can start selling them during the October and November craft shows. It’s a killjoy! You know the feeling when you walk into the stores and they start putting Christmas stuff out in October, many, including us, seem to stop and say “SERIOUSLY!” Talking about Christmas seems to put big damper on the rest of the summer. This has been one of the more popular Christmas savings plans throughout the years that we have created for our readers and so we wanted to remind you to dust it off and get going (or print more for free!). However, you need a Christmas Savings Plan to have a debt-free Christmas. I mean at this point, we are at the beginning of October and fall really just started, just barely sipping our hot cider and settling into a warmer start to the autumn season.

#Savings planner printable code

I use highlighters to color code the items on this tracker.It seems a little early to be talking about Christmas. There are 3 months on each page with dates from 1 to 31. Quarterly log (NEW!) – This is what I personally use to keep track of my bills and other things. Notes – These are blank pages so you may personalize your planner by drawing charts or adding more lists, like meal plans, grocery list or construction expenses. (I only list down unplanned expenses because I already have a bills calendar for my planned expenses.)

(My categories now are savings, insurance, taxes, rent, groceries, and bills.)īills and expenses tracker – Keep track of your bills due and daily expenses. The categories chart is where you list down money for savings, sinking funds, rent and other expense categories. (The rest of our money are on our other savings accounts so I don’t overspend.)īudget planner – This is where I plan my budget for the month. This helps me check if I have just enough available balance on my credit card or debit card for that week. I write down the monthly bills due for each day and other regular expenses like groceries or dog food. Monthly bills calendar – Each month has a unique floral theme. Future log – I use this for listing down annual and quarterly bills and major celebrations that require more than usual spending.

0 kommentar(er)

0 kommentar(er)